Managing a multi-unit property sounds like a straightforward path to wealth, but when it’s shared among numerous heirs across generations, it becomes anything but simple. As founders pass away, their legacy of buildings often falls into the hands of second and third-generation family members—some of whom are active in the business, while others are not. This imbalance can lead to frustrations, as aging properties require ongoing capital reinvestment, resulting in declining cash flow and growing tensions over who’s contributing and who’s simply cashing in. The need for reinvestment and conflicting priorities among family members make it crucial to adapt the original ownership structures that worked for the founders but no longer suit a diverse and expanding set of stakeholders.

To keep these family legacies thriving, a re-evaluation of ownership every 15-20 years is essential to align with the evolving needs of new generations. Balancing the expectations of multiple family members with differing viewpoints demands empathy, clarity, and a proactive approach. For insights on successfully managing these complexities and preserving harmony in multi-generational real estate, read our full white paper HERE.

If you’re interested in this topic, be sure to register for our upcoming free webinar on Motivating Generations II-III into Your Real Estate Business.

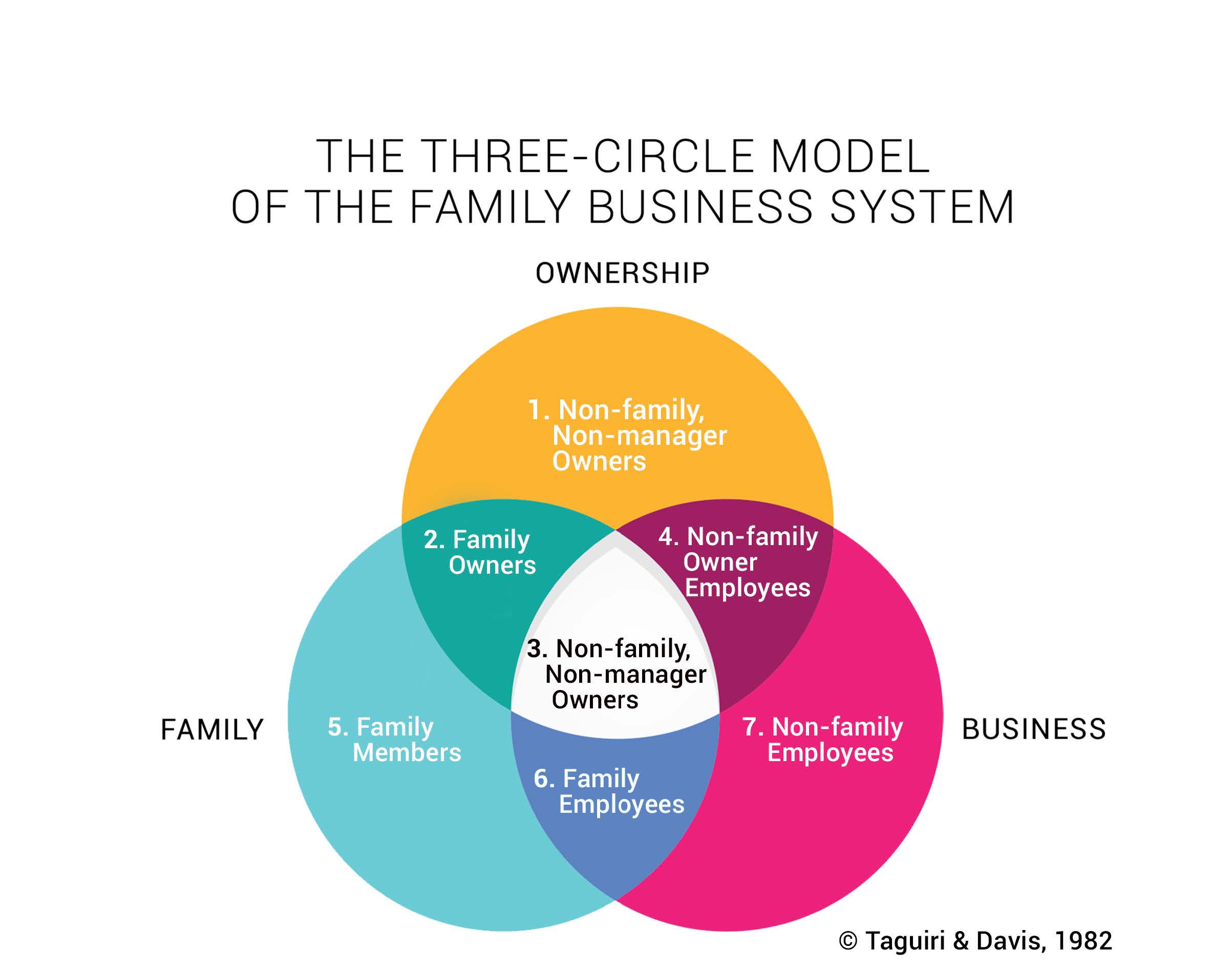

This image identifies the 7 different categories of individuals involved in a family business. Each group will bring different experiences, viewpoints, and priorities to the table. It takes concerted effort to work together to achieve a reasonable outcome for all involved