“To make more money, you either make better deals or find cheaper capital”

The Big Picture

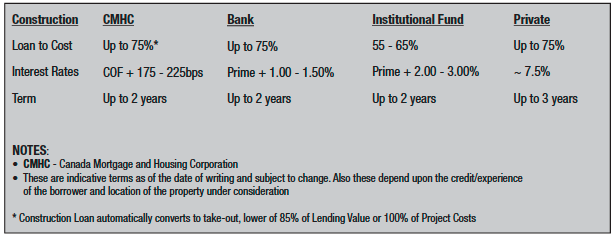

The following chart breaks down the components for financing construction land from loan-to-cost, interest rate, term, fees, to guarantee.

*All numbers are based on 2021 data*

What a developer must realize is that land deals are difficult and complex. Also, it’s not easy to do a precise evaluation on a piece of land.

The Institutional Investor

Land is always in great demand for the institutional investor. However, they only have a small percentage of their funds available to buy such land.

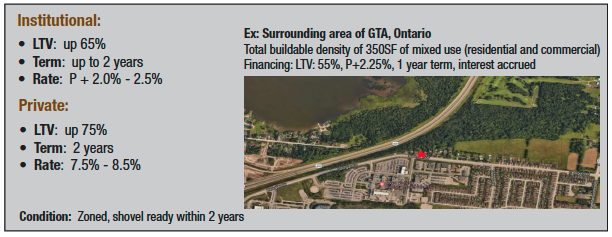

Multi-Residential Land

*All numbers are based on 2021 data*

Institutions want to purchase land that is already properly zoned and shovel ready. The typical institutional land loan can be up to 65% loan-to-value with a team of two years. Institutions do not like to go beyond two years, doing so only in exceptional cases. However, they always want construction to begin within that two-year period.

Also, they normally want to be your partner. They feel that if they’re going to proceed with a land loan and assume some of the risks, they would rather get involved with the construction and in the exit strategy as well. As far as rates go, the range of interest will likely be prime plus 2% to prime plus 2.5%.

The Private Buyer

Although perceived negatively, private lenders are not always an unfavourable option. People often think that if they don’t qualify for an institutional loan, going private forces them to accept higher interest rates. While that is the case, a private lender serves two purposes that institutional lenders do not address: leverage and flexibility.

Leverage

Firstly, a loan from a private lender can give you more leverage. As can be observed from the above scenario, the institutional lender is offering a loan for 65% of the estimated value while the private lender will go up to 75%. This lets a developer retain more of their equity for construction.

Flexibility

Secondly, private lenders give the developer more flexibility in timeline. For example, if a developer is considering purchasing a piece of land that is zoned in the Official Plan as residential and requires little to no rezoning work, a private lender can give you a bridge loan for two years as well. There is definitely a market for this.

For the additional risk carried by a private lender, you pay a higher rate – it’s 3% to 5% above prime depending on individual circumstances. However this is often offset by the flexibility you get.

Want to know more?

Tell us about your project: https://svnrock.ca/multifamily-research-consultancy/feasibility-studies/

Visit our Apartment University: https://learn.derek-lobo.com

OR view our Apartment Developer University Recordings http://svnrock.ca/adu-recordings-offer/