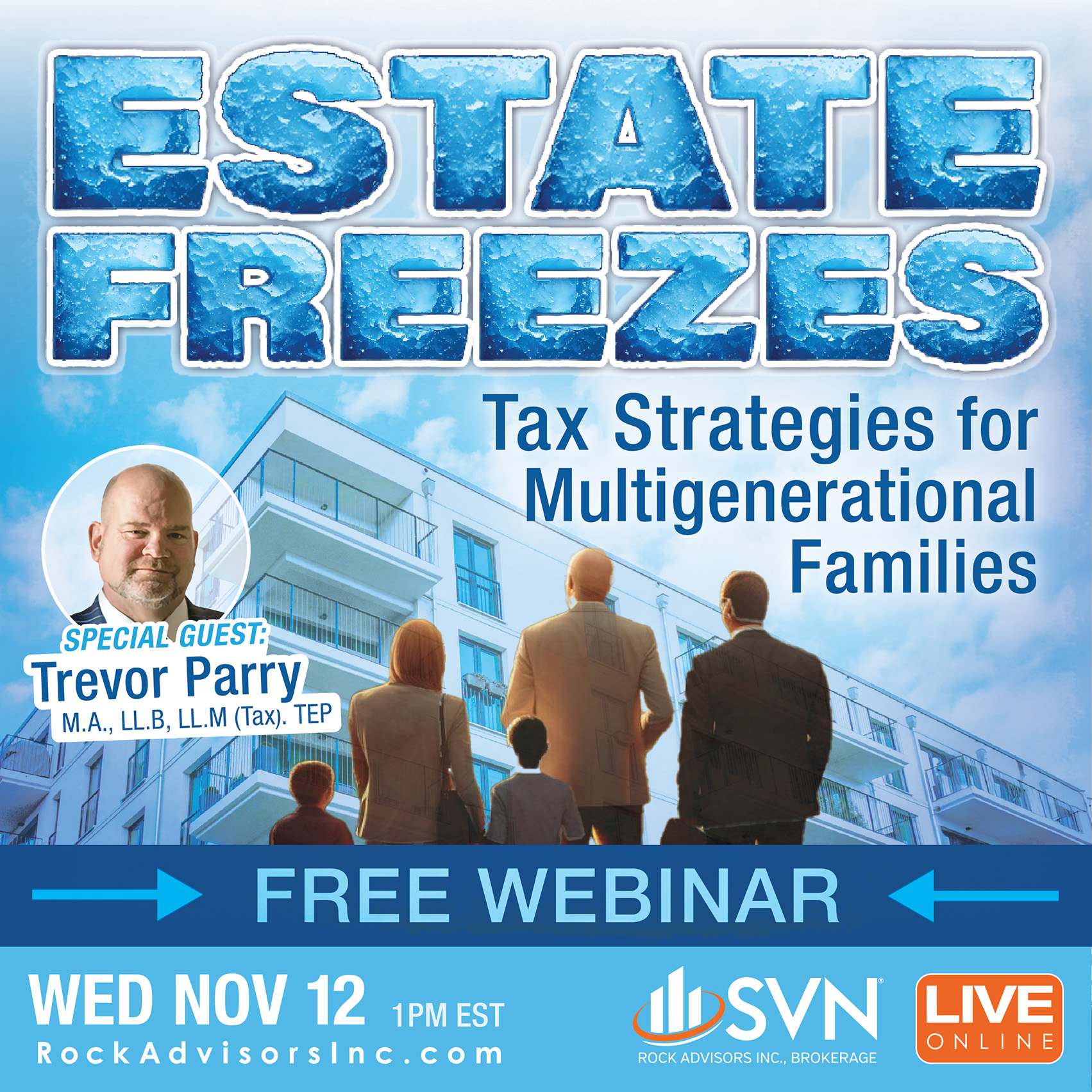

Estate Freezes for Real Estate - Tax Strategies for Multigenerational Families

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Are you a real estate developer or owner looking to minimize future tax liabilities and smoothly transition your wealth across generations?

Join us for an insightful webinar specifically designed for real estate investors, developers, and multigenerational families. The Estate Freezes for Real Estate webinar, featuring Trevor Parry, M.A., LL.B, LL.M (Tax). TEP, will demystify one of the most powerful and often misunderstood tax planning strategies available: the estate freeze.

In today’s dynamic real estate landscape, proactive tax planning is crucial. As property values continue to appreciate, so does the potential tax burden on your estate. An estate freeze allows you to cap the value of your current real estate holdings for estate purposes, effectively “freezing” the growth in your hands and shifting future appreciation to the next generation, often with significant tax advantages.

What to Expect:

- Understanding the Estate Freeze

- Benefits for Real Estate

- Impact on Apartment Developers/Owners

- Key Considerations & Common Pitfalls

- Multigenerational Wealth Transfer

Who Should Attend:

- Real estate investors and property owners

- Developers and landholders

- Business owners with significant real estate assets

- Individuals planning for retirement and estate distribution

- Families seeking to transfer wealth efficiently to the next generation

Don’t miss this opportunity to gain valuable insights into protecting your real estate wealth and securing your family’s financial future.

Featured Speakers:

Derek Lobo

CEO & Broker of Record

SVN Rock Advisors Inc.