LOOKING BEYOND THE EASY DATA

Developers Need to Look Deeper to Build the Apartments in the Marketplace.

Mark Twain popularized the saying, “there are three kinds of lies: lies, damned lies, and statistics.” The saying actually was first attributed to British prime minister Benjamin Disraeli. The words may be wise, but I find it to be a little cynical.

Statistics are a powerful tool, but just as a hammer in the wrong hands can be dangerous, it’s important to know what exactly you are doing with statistics, and how to wield them.

We live in a world where statistics and information are very easy to get. We can Google up lots of information about any number of subjects. Some say that Wikipedia has made the Encyclopedia Britannica obsolete. In a tremendous boon to common knowledge, Statistics Canada makes its data from the 2016 census widely available. In real estate in general and the rental apartment industry in particular, rental market reports are easily available from Canada Mortgage and Housing Corporation, and sites like Urbanation. This is all to the good.

However, just as there isn’t a school anywhere that will give a student a passing grade for an academic paper citing only Wikipedia sources, a developer that relies on a superficial understanding of readily available statistics is likely to be surprised by the nuances of the marketplace they are investing in.

Going in Without Looking

In the real estate industry, developers can be tempted to move too quickly on an investment. They try to save money by skimping on the market research and looking up and assessing the statistical data on their own. This rarely goes well for them. Quite often, these developers end up leaving money on the table that they could have picked up through a more thorough and in-depth understanding of the marketplace.

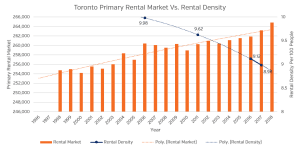

The disadvantage of doing only perfunctory research shows up in a few ways. Most publicly available data from organizations like Canada Mortgage and Housing Corporation or Statistics Canada give a very good assessment of local marketplaces, identifying the average rents and vacancy rates of cities and sections of cities. It is possible to identify general trends to see that, say, Windsor is recovering from a period of high vacancies, or that Hamilton’s average rents are rising. One can easily see that downtown Toronto’s market features far more one-bedroom units than three-bedroom units, while the reverse is true in the neighbourhoods of Mississauga.

But such general data will not tell a developer if a particular site can corner the market in a rising neighbourhood, or if competitors are already rushing in and are likely to beat the developer to the punch. For more fine-grained data, researchers look beyond what Statistics Canada or CMHC can tell them. Data such as what’s being developed, and what rents other developers are achieving are not available from public sources and require time and attention to tease out.

What is Versus What Will Be

Then there is the question of bias. While Statistics Canada and CMHC have taken every step to avoid bias from appearing in their data, having a developer research that data before making an investment decision introduces the developer’s own biases into the process. A developer may be too enamoured by their development idea to notice an unfavourable trend. A team of researchers who have no direct interest in the outcome of whether a development enters construction or not will have no conflict of interest and can provide an analysis of the data that is unbiased, and is more likely to accurately assess whether the development is a worthwhile investment or not.

Getting Ahead of the Competition

Finally, even if one could rely on publicly available data to be fine-grained enough and predictive enough to base a sound investment decision on, a developer who relies on this fact forgets that this same data is readily available to the competition. This is a recipe for creating a cookie-cutter rental apartment marketplace, where no special nuance has created outstanding developments, and where everybody’s investment underperforms. Even if a developer plans to sell their development upon completion, there will be a pipeline of similar product right behind that will depress your project’s value.

We are all after the best rents. We all like looking at the CMHCs rental statistics and imagining our buildings making better than the best right now. But with a team of dedicated and experienced researchers conducting a thorough and unbiased study of the local marketplace, a developer doesn’t have to imagine making better than the best rents. They only have to plan.

Let Others’ Experience Guide.

At SVN Rock Advisors, we have over three decades of experience in the purpose built rental apartment marketplace. We have helped shepherd many developments to completion, lease-up, and sale. By looking beyond the publicly available data and finding the trends and characteristics deep within the marketplace, we have offered unbiased advice that has helped developers, investors, and financiers invest in the market with confidence. Our detailed feasibility studies ensure that our clients don’t go in blind.

As a developer, you deserve to design the best building, and to do that, you have to know exactly the renter you are targeting. At SVN Rock Advisors, we can find the renters hidden by today’s publicly available statistics.