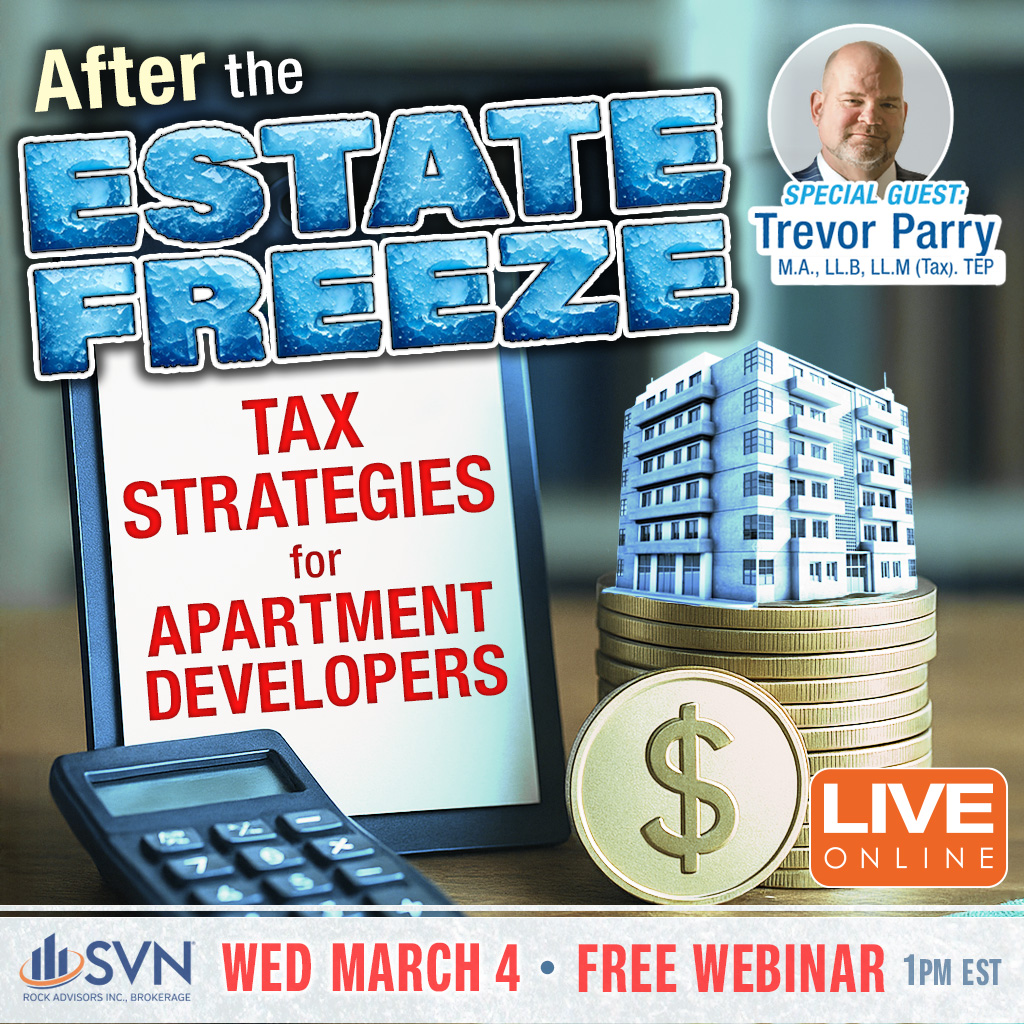

After the Estate Freeze - TAX STRATEGIES for APARTMENT DEVELOPERS

Day(s)

:

Hour(s)

:

Minute(s)

:

Second(s)

Are you a real estate developer or owner looking to minimize future tax liabilities and smoothly transition your wealth across generations? And, if minmizing taxes is always at the forefront of your business decisions, then join us for the second webinar in our Developer Tax Series.

This webinar is specifically designed for real estate investors, developers, and multigenerational families. After the Estate Freeze is a webinar, featuring our developer tax expert, Trevor Parry, M.A., LL.B, LL.M (Tax). TEP,. As he did back on November 12th, he’ll demystify the taxation hurdle that all apartment developers live daily.

In today’s dynamic real estate landscape, proactive tax planning is crucial, and there are strategies to deploy that can minimize the burdens of taxation. Property value pressures are magnified by today’s economic climate and every opportunity to save is important.

What to Expect:

- Now that you’ve heard about the Estate Freeze (if not, check out the recording here: https://youtu.be/txuOIsx20h8)

- Learn about what’s next in tax strategies for apartment developers

- Key Considerations & Common Pitfalls

- Multigenerational Wealth Transfer

- Join us as Trevor Perry unlocks the strategies for Apartment Owners and Multigenerational Families

Who Should Attend:

- Real estate investors and property owners

- Developers and landholders

- Business owners with significant real estate assets

- Individuals planning for retirement and estate distribution

- Families seeking to transfer wealth efficiently to the next generation

Don’t miss this opportunity to gain valuable insights into protecting your real estate wealth and securing your family’s financial future. Register today!

Featured Speakers:

Derek Lobo

CEO & Broker of Record

SVN Rock Advisors Inc.